Micro-sized businesses have always been very popular models, with low start-up costs and easily manageable operations. They’ve become even more so with tech and e-commerce development. If you’re interested to learn how microbusiness functions and what are its pros and cons, we can help you find out all the answers you need.

Microbusinesses are commonly defined as businesses that operate on a very small scale, with less than ten employees and low annual revenue. This company model demands much lower expenses but also offers more freedom in managing a company. However, microenterprises are considered high-risk businesses with low capital, bringing certain financial difficulties for the owners.

What Is a Microbusiness – A Simple Definition

Microbusiness is a type of small business with a very low number of employees on the one hand and low annual revenue and starting up costs on the other.

However, keep in mind that different states or even localities can have various regulations and microbusiness definitions. California, for example, sees microenterprises as businesses with up to $2.5 million in revenue per last three years or an enterprise that has up to twenty-five workers. Connecticut, on the other hand, defines it as a company with annual revenue of $500,000 or less.

In some cases, this term is used to describe a sole proprietorship with an owner as an only employee. At the same time, keep in mind that definitions of a microbusiness can depend on the industry in question.

Types of Microbusinesses

These enterprises have a significant part in the US economy – they are the most common types of businesses. However, with only a few workers, they don’t provide many private-sector jobs.

Microenterprise is suitable for different types of businesses in various fields, from retail and social assistance to healthcare, business administration, communication, and construction. This company model is a very common form with:

- Freelancing (writing, programming, designing, and the like),

- Dropshipping business,

- Home-based enterprises,

- Small grocery stores,

- Independent contractors,

- Street vendors,

- Small farmers, and so on.

Microbusiness vs. Small Business

According to the Small Business Administration, small enterprises are all those that have less than $38.5 million in revenue per year or less than 1,500 employers in total. Small business standards differ between the industries. For example, in wholesale trade, an enterprise will be defined as small if it has less than one hundred workers, while an agriculture company needs to have an average annual revenue of $750,000 or less.

Microbusiness, on the other hand, is its subcategory, distinguished by even lower annual revenue, starting up costs, and a number of employees. Although this enterprise model can be favorable for many, it does come with a few downsides compared to bigger-sized small businesses.

Which Legal Structure Can a Microbusiness Have?

Legal structure determines who is a company’s owner, but keep in mind that it can affect how small businesses pay taxes and even interfere with daily operations. Usual company structures for microbusinesses are:

SOLE PROPRIETORSHIP

It’s the most common business structure where the owner is responsible for all operations and funding. It’s an excellent solution for people with small business ideas who plan to work alone.

PARTNERSHIP

It implies that there are two or more owners who run the enterprise. Partners can be general and limited (like investors). It can be a good fit for people looking to reduce the costs of starting a company. Additionally, many enterprises can benefit from combined knowledge and other perspectives.

LIMITED LIABILITY COMPANY (LLC)

LLC is an excellent solution for a high-risk business since the owner won’t be held responsible for the financial and legal issues of the company. It can provide an owner with significant tax benefits, as well. However, LLCs can have many shareholders, and they need to report to the government, both state and federal.

CORPORATION

People who don’t want to hold any kind of personal liability for the company’s operations will see the corporate structure as most fitting. However, note that forming a corporation brings high costs compared to other structures.

Pros of Micro-sized Businesses

Owning a microenterprise comes with many significant benefits. The most obvious ones are financial in nature – a micro business brings the lowest costs compared to other, larger company models. Aside from paying out a fewer number of salaries, the cost of company operations tends to be much lower, with broader possibilities for a tax deduction. Think about all those in-home offices that don’t demand any cost of renting (or buying) an office space.

Micro-sized businesses have fewer departments and processes to supervise, which is suitable for entrepreneurs who want to achieve a simple workflow. Fewer employees and departments also imply good communication between existing sectors.

At the same time, keep in mind that microbusiness undoubtedly brings more freedom. With them, an owner can change the smallest details but also redirect a company toward other goals without difficulties a larger company would suffer.

Possible Difficulties a Micro Business Owner Can Meet

Micro-sized businesses take time to develop, and it’s expected that many people don’t see profits within the first year or even longer. That is why they belong in a high-risk category and have difficulties obtaining the necessary funds. Still, even with a loan, microbusinesses don’t have many marketing resources, making attracting customers quite challenging, which is another downside of this model.

Simultaneously, these types of enterprises have between one and nine employees, which oftentimes means that each employee has a larger workload and higher responsibilities, including the owner. Overburdening a few workers is one of the common mistakes business owners make, but remember that it can have a very counterproductive effect.

Marketing Techniques Suitable for Micro-Sized Businesses

Reaching the targeted group and securing loyal customers isn’t a simple task for microenterprises. Not only do they not have enough resources for vast promotion, but they usually lack knowledge and network for successful marketing campaigns. In these cases, digital advertising, like social media marketing, can be a perfect, low-cost solution. Modern digital marketing tools are simple to use and relatively easy to implement.

What Is a Microloan Program?

Whether you decide on bricks and mortar, e-commerce business, or their combination, you may need a loan at one point – for a start-up or expansion. However, lenders tend to avoid dealing with microenterprises. Why is that? These micro-sized businesses don’t usually have high revenue initially, which can affect their loan payments – but that is not all. Microenterprises usually require low loan amounts that aren’t interesting for many creditors.

When getting a loan from a local bank or an independent lender is not possible, consider the microloan plan offered by the Small Business Association. These loans go up to $50,000 (but can be as low as $50) and are usually financed by so-called microlenders. These microlenders are typically non-profit organizations that want to invest in an innovative idea and a company that couldn’t get the necessary funding any other way.

Money obtained with this microloan can be used for various purposes, like supplies, promotions, seasonal expenses, working capital, and so on.

Additionally, some states also tend to provide help for small entrepreneurs by offering not only funding but also workshops, counseling, and networking (for example, Vermont is home to Microbusiness Development Program).

Are You Looking for a Perfect Niche? Here Are Some Interesting but Profitable Micro Business Ideas to Consider

The success of a micro-sized company can highly depend on its sector. Companies belonging to the IT and marketing fields shouldn’t have problems gaining profit, but not all microenterprises come from these sectors. If you’re not an IT or marketing expert, explore some of the following niches:

- Child care,

- Beautician services,

- Online tutoring,

- Fitness and health,

- Food delivery,

- Home cleaning,

- Pet walking and grooming,

- Aerial photography,

- Personal errand services.

What Do You Need to Start a Micro Business?

Starting a microbusiness has all the steps an owner would need to follow with any other model, such as:

- Exploring the market,

- Creating a strategy,

- Deciding about the company type (online or brick and mortar),

- Finding the location (for those who’ve chosen to look for a physical store or office),

- Deciding on the name and company structure,

- Registering a company,

- Getting EIN (employer identification number),

- Getting tax ID (necessary in some states),

- Applying for a license and necessary permits,

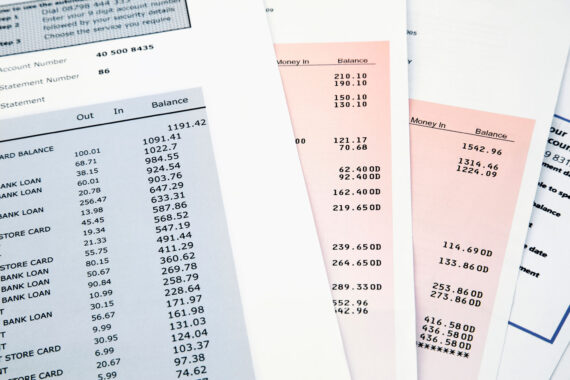

- Setting up the company’s bank and merchant account.

Credit Card Processing Services Are Necessary for Many Microbusinesses

Any service-based microbusiness that offers card payments needs merchant services for credit card processing. Many microenterprises depend on customers, so good entrepreneurs must do everything in their power to make the customers happy. Aside from good customer service, providing customers with different payment possibilities is necessary nowadays, when cash is slowly becoming a thing of the past. Moreover, keep in mind that many e-commerce payment options demand some sort of credit card processing.

However, getting merchant services is not always easy when owning a microbusiness – low capital, especially at the beginning, doesn’t combine well with many card processing fees and markup every payment processor requires. More likely than not, owners of microenterprises will search for the lowest credit card processing fees as well as a free POS system to reduce the cost. However, there are plenty more things to consider when looking for the best credit card processing for small businesses.

How to Choose the Best Payment Model for Your Business?

When it comes to the best payment models offered by a processing company, it’s important to distinguish how many card payments you expect in the future. A flat-rate model offers predictable financial obligations each month, while interchange-plus pricing is more transparent and can help you save in the long run.

Service-based microenterprises that want to reduce processing costs shouldn’t underestimate the benefits a cash discounting program can offer. Encouraging customers to pay with cash means fewer card transactions, resulting in smaller card processing expenses.

When Looking for the Best Credit Card Processing Company for Your Microbusiness, Choose Merchant Chimp

As in any other industry, not all credit card processing companies are the same. With Merchant Chimp, transparency is guaranteed – not only that we offer lower fees, but with us, you’ll always know what you’re paying. But that is not all! Merchant Chimp also offers financial consulting free of charge, a user-friendly experience, and the possibility of next-day funding. When you’re looking for a partner to help your microbusiness grow, make sure you contact us and learn more about the services we offer.