Plastic that allows you to pay for services and products has been around since the 1950s. And since then, it has been transformed and developed, bringing us different types of credit cards. Since numbers don’t lie, they show that plastic has become essential to the economy. So, let’s check credit card statistics that will show you just how applicable and useful plastic can be to both customers and businesses.

Credit Card Statistics in the US by Generation and Ethnicity

There are many things people don’t know when it comes to credit cards (CC). From how do CC machines work to the importance of merchant services credit card processing companies offer. However, if we want to see the bigger picture, let’s start with the basics – the users.

You should know how many credit cards does the average American have because that will give you the first insight into ownership stats. The Report on the Economic Well-Being of US Households shows that an average American holds 3 CC. On top of that, the report shows that 83% of all adults had at least one in 2020. When it comes to the age of users, Gen Z holds the lowest average number of CC, while Boomers hold the highest (that being 3.5 CC).

Furthermore, the usage varies by race and ethnicity, so around 87% of white adults are CC owners, while that number is a bit higher for Asian adults (around 90%). Also, around 76% of Hispanic and 72% of Black adults own CC.

Credit Card Facts About Issuing Networks You Should Know

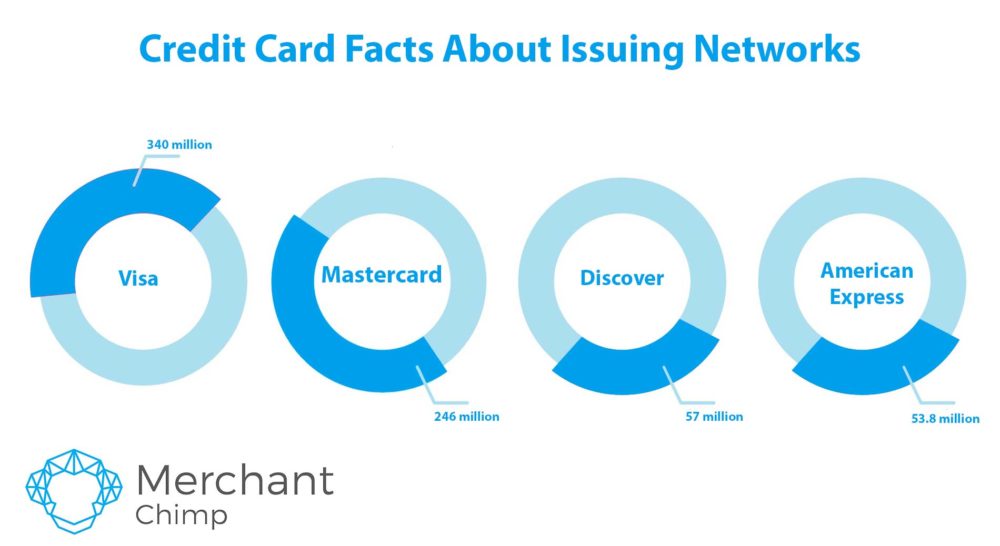

An issuing bank is a financial institution that gives the CC to its clients, while a network is a company that provides a communication system that allows transactions. Visa, American Express, and Discover are just some of these networks. And some are more popular than others, so let’s check the data and see which is the most used network in the US:

- Visa is by far the most popular network with 340 million CC in circulation,

- Mastercard with 246 million CC is in second place,

- Discover has 57 million CC in circulation,

- American Express counts 53.8 million CC.

Credit Card Fraud Statistics Every Consumer Should Be Aware Of

Even the cardholders are not immune to fraud and theft. And that can be seen in these numbers:

- CC fraud is the number one type of identity theft fraud,

- Approximately 46% of the world’s CC fraud happens in the USA,

- Almost 33% of cardholders in the US experienced fraud in 2019,

- Alabama is most at risk, while South Dakota is the safest from CC crime,

- Americans lose around $230 per scam,

- In 2019 around $232 million was returned to the victims of fraud.

Even though there are different card fraud prevention methods, with the rise of the e-commerce industry, the ways people are being scammed are becoming more and more innovative. One of the newest ways is synthetic identity fraud. This means that the thief takes some real info to create a fake identity similar to the real one.

Credit Card Debt Facts That Will Leave You Speechless

According to data from the Federal Reserve Bank of New York, cardholders in the US are in a lot of debt. These stats show that an average American has $5,525 CC debt. Furthermore, these credit card debt statistics show that the state with the highest average debt is New Jersey ($7,872,) while the state with the lowest such debt is Kentucky ($5,441).

The stats also show that Generation X has the most debt ($7,236). On top of that, consumers in the middle-income brackets are the ones that will most likely have CC debt. The good news for cardholders is that the delinquency rates have been steadily decreasing.

Credit Card Myths and Facts About the Impact of COVID-19 on Consumers

Since the Covid-19 started, we all had to adjust our day-to-day activities. From hanging out with friends and going to work to shopping habits – all of it changed. However, many e-commerce business models started to thrive in a rapidly changing world. So the biggest mistake business owners could make lately is not allowing their customers to shop on the internet (and use their CC). That being said, the stats show that online retail sales were up almost 40% in 2021.

Furthermore, the increase in online shopping faced many with unprecedented financial struggles. The data shows that almost 42% of adult Americans with CC debt have increased those balances during the pandemic. The numbers also point out that almost 50% of people have been in debt for more than a year.

If you are struggling with keeping the debt under control during the pandemic, check out some useful tips in the video below.

Stats About Payment Transactions Both Small Businesses and Customers Need to Know

To be better than the competition, you have to be a step ahead of them. That means being in tune with the needs and desires of your clients, especially when it comes to payment options, which means allowing them to use CC, checks, and mobile payments.

For starters, 35% of customers would be interested in paying with Apple Pay or some alternative mobile app. However, only around 4% of small businesses allow that kind of payment. Having mobile payments as an option will attract customers that don’t like to carry physical wallets.

Allowing the customers to pay with their chosen method is important because 41% of them will avoid your business if it doesn’t accept that payment option. Furthermore, if you are aiming to attract a younger crowd, know that people under the age of 35 are twice more likely to avoid your business if it doesn’t accept their chosen payment method.

Credit Card Statistics Small Businesses Should Take Advantage Of

The popularity of plastic has been steadily increasing over the last two decades, so having a business that doesn’t accept them is quite rare. According to Community Merchants USA data, almost 66% of all POS transactions are done via credit and debit cards. Also, nowadays, with the right credit card processing company as your partner, you won’t need complicated machinery to allow this type of payment.

However, even with the tech development, some small business owners are still reluctant to accept CC. Some of them are probably considering how different credit card transaction fees are affecting their profit. Just remember, you can calculate credit and debit card fees into your pricing.

Furthermore, as a business owner, you should know that customers tend to spend more when they are paying with plastic. Data shows that the average non-cash transaction is around $110, while the cash one is $22.

Accepting Credit Card Payments Come With Many Additional Benefits

Accepting CC as a form of payment is not only seen in numbers but also in the way it:

- Legitimize the business – cardholders will know they can trust the business that provides them with many paying options besides cash. And this way, your enterprise will be established as legit in the industry.

- Boosts sales – because of CC’s popularity nowadays, businesses that accept these types of payments will have a bigger base of customers.

- Eliminating the risk of bad checks – enterprises won’t have to deal with bounced checks and tracking down customers to properly pay for the service. With CC, you can instantly know if a person has funds on their account or not.

If you want to learn more about the benefits of accepting CC payments, check out the video below.

In the End, What Do Statistics Tell Us About CC

We saw how using credit card processing services can actually benefit the growth of your business. All of these statistics show that owning plastic is becoming more popular with time. And that should be one of the main reasons why your enterprise needs to incorporate CC payments. Adding different payment methods will be good for the profit because only 16% of small businesses offer more than three of them. Not only will they increase sales, but they will give you an edge over competitors. And as a business owner, that is something you should strive for.