When searching for merchant services, the majority of business owners tend to pay particular attention to the nominal credit card processing prices offered by processors on the market. But to calculate the total cost of accepting cashless payments, the so-called effective rate, and to determine the most affordable one for your enterprise, you need to get the full picture of the various pricing models and cost components.

What Are Merchant Services Rates?

Merchant service rates are the charges imposed by processors for their credit card processing services. To put it simply, that is the money you have to pay to your merchant service provider in exchange for the ability to accept plastic from your customers. Their level is determined by the provider you are working with, as well as certain non-negotiable factors set by issuing banks and brands such as Visa and Mastercard. It involves interchange costs, assessment or service charges, and, most importantly, the payment processor’s markup.

Understanding Different Credit Card Processing Costs

Each credit card transaction includes three cost components: interchange, processor markup, and assessments.

Interchange

The interchange fee is the amount of money that will go to the banks that issued the cards used for each payment. The processor and yourself have no control over it, as it depends on the bank and the type of card. There are different interchange categories, but your processor doesn’t get to decide which ones will apply to their payments. Therefore, they are often referred to as non-negotiable.

Assessment

The assessment charge is the amount of money that will go to the card brand (Mastercard, Visa, American Express) per transaction. These are the same for all processors, and they can’t be changed under any circumstances.

Processor Markup

The only component that the processor can control when it comes to credit card processing is the markup. The markup is anything that your chosen processor will charge you over the sum of assessments and interchange fees. It is mostly charged as a percentage of the transaction with an occasional added fixed charge, depending on the pricing model.

What Are the Most Common Pricing Models?

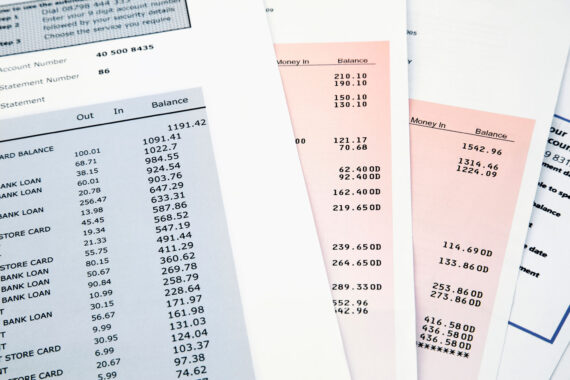

The way processors calculate and collect the overall processing costs and their markup determines your pricing model. When you receive your processing statement, make sure to check which type of pricing you have – tiered, interchange plus, or flat-rate. The pricing model you have, along with the specific processor, will give you an insight into the individual fees that will appear on your bank statements.

Tiered Pricing

If you opt for tiered pricing, the different cost categories will be divided into tiers, so you’ll get a rate depending on the tier. At the same time, which rate will apply to what transaction depends entirely on the processor.

There are qualified, mid-qualified, and non-qualified tiers, and they all come with different costs and usually don’t include assessments. This type of pricing often doesn’t include a solid percentage, either. It is very vague and easily manipulated by the processor, so it’s typically not a good option for your business when you’re searching for the best credit card processing company.

Interchange Plus Pricing

Interchange plus is a relatively transparent pricing model with the potential to help you secure the lowest rates. The assessment and interchange costs are separated from the markup, which is actually the only component that can be negotiated. And that markup is the amount the processors will provide you with when you ask for a “rate.”

Flat-Rate

A flat rate is a single fixed price that won’t change under any circumstances, regardless of the cards that were used for each transaction.

Discover What Individual Fees You Might Have to Pay

Aside from looking at the pricing models, you need to get information about all the individual fees – both small and big – that you’ll have to pay to your chosen processor each month.

Authorization And Transaction Fees

An authorization fee is charged when the bank that issued the card that is being used approves it for payment. Keep in mind that you will be charged for this, even if the request has not been approved. To turn the authorization into a transaction, you will also be charged a small transaction fee.

Due to the fact that a certain card might not get authorized for a transaction, processors will charge you either for each authorization (regardless of whether it was turned into a transaction fee) or simply per every transaction. However, keep in mind that you, as a merchant, should never be charged for both authorizations and transactions.

Monthly Minimum Fee for Merchant Payments

You can also be faced with a minimum monthly charge that a company can impose to ensure that you, as a merchant, will pay a certain minimum amount of money to cover the provider’s cost of maintaining your account. In case you don’t match the monthly fee minimum, you will be charged the difference up to the month’s minimum amount.

Annual Fee

Speaking of costs for maintaining a merchant account, apart from having a minimum for each month, you can also have an annual fee that some providers charge for the maintenance of your account. With the annual charge for your account, you are also paying for the Payment Card Industry (PCI) compliance that can include insurance policies in case of cyber attacks and breaches.

Early Termination Fee

Some providers can charge you an early termination charge if you decide to end the contract earlier and terminate your account. Most one-to-three year contracts have very standard terms, but some of the five-year ones can have a one-year cancelation notice. Failure to meet this notice can cost you.

Chargeback Payment Fee

When it comes to chargeback-related costs, your acquiring bank will deduct chargeback fees and reimbursements from your merchant account, typically in the range $15 and $30, plus the transaction cost.

What Is an Effective Rate?

An effective rate is the actual amount of money you need to pay for being able to accept cards as a method of payment, divided by the money that is processed. It is not set by your processor, but it can be used to compare the total costs of different models.

To accurately calculate it, just divide the total amount of fees with the amount of money that was processed, and then compare different ones to find the best pricing model for your specific business.

Things and Features to Consider When Looking for the Best Merchant Services Rate

One of the most important things you need to keep in mind is that the company with the lowest nominal rates may not be the cheapest. Calculating the full amount you’ll have to pay for the payments made with credit cards is not an easy thing to do. There can be very variable rates and hidden fees that can cause a lot more expenses than you initially expected.

Another thing you need to look for is what features you will get from your processor. Finding the cheapest processor may not be the most suitable option for your business. It’s natural to look for a way to accept cards without having to pay an excessive amount of money for that convenience. However, a company that offers a low rate usually saves on other aspects of the service, like poor customer service or bad POS terminals that won’t process your payments.

Instead of looking at just the price, look for the additional things you get with those costs. Not all companies that have excellent offers at a small price will cut corners where it counts, but some will, so make sure you see what you are getting at that rate.

Choose the Best Payment Option for Your Business

While looking at the best pricing option for your business, you need to get quotes and compare features between different processing companies. Make sure you carefully look at both the rates and fees to find the most suitable option of processing credit or debit card payments from your customers.