Intuit is a credit card processor best known for its accounting software called QuickBooks. Those interested in finding out more about intuit merchant services fees should know that Intuit’s offer is considered one of the most expensive in the credit card processing industry.

What is Intuit Merchant Services?

Intuit Merchant Services, also known under name Intuit Payment Solutions, provides credit card processing services. The service is accessible with or without QuickBooks, meaning that those who want to utilize QuickBooks don’t need to use processor’s Payment Solutions.

Integration of Credit Card and QuickBooks

Intuit’s accounting software makes it easier for clients to record and process transactions. It was designed in a way that it only worked natively with Intuit.

Even though users need to have an Intuit account to integrate with software directly, it does not mean that they will not have the alternative of getting their information into Intuit’s accounting software. Many plugins allow integration that works the same way as direct integration, only virtually.

On the other hand, those who don’t want to utilize plugins have the option of using export/import option to send details about transactions from their chosen processors to their QuickBooks accounts.

Is It Mandatory to Use Intuit Credit Card Processing If You Utilize QuickBooks?

Those who are using Intuit’s accounting software are not obligated to use Intuit’s processing services. The good news is that many processors are offering plugins that make it possible for users to synchronize information about each transaction with Intuit’s accounting software.

Do You Have to Use QuickBooks If You Only Want to Utilize Intuit Credit Card Processing

Merchants don’t have to utilize Intuit’s accounting software if they want to use the company’s credit card processing. But, they should think about the benefits of using them both. The main advantage of using Intuit’s processing services is its seamless integration with the accounting software. Customers who don’t want to utilize software but want to use Intuit Payment Solutions will only have the option of accepting their payments through Intuit’s mobile processing service called GoPayment.

Information About Intuit Merchant Services Fees

When it comes to costs, it is thankless to talk about precise figures because the processor has been changing pricing models from time to time. The best way to keep track of your expenses is to always check your monthly statements.

One of the Costs of Using Quickbooks Online is 2.4% and 30 Cents

Pay-as-you-go is the only option given to those who utilize the Online version of Intuit’s accounting software and also want to accept cards through Intuit. Pay-as-you-go doesn’t come with a monthly fee, while the costs of money transfer depend on how users accept cards.

All swiped cards cost merchants 2.4% and 25 cents per transfer, and invoicing payments will be charged 2.9% and 25 cents per transaction. Keep in mind that the fees for keyed in transactions are 3.4% and 25 cents for each payment, making them the most expensive category.

Charges for QuickBooks Desktop

Users who want to utilize QuickBooks desktop credit card processing have two options. The first option is a monthly plan, and the other is pay-as-you-go without a monthly fee.

Pay-as-you-go option includes the following:

- For swiped cards, users will need to pay 2.4% and 30 cents for each money transfer

- For the keyed plastic and invoiced payments, users will need to pay 3.5% and 30 cents for each payment they receive.

On the other hand, the monthly plan charges 3.3% and 30 cents for keyed-in card transactions and invoiced payments, and 1.6% + 30 cents for swiped ones. A monthly plan also includes a $20 charge per month.

A Bit More About Processing Costs

In the beginning, the company was mostly using tiered pricing, while now it includes other models. From recently, the processor is also using a flat price model.

Most Convenient and usually the Most Expensive: Tiered Pricing

Intuit is using tiered pricing to charge its services. This model permits the processor to charge each service by defining rates as non-qualified, mid-qualified, or qualified.

Every pricing tier has a reciprocal rate, meaning that NQUAL, MQUAL, and QUAL can have rates of 3.6%, 2.60%, and 1.60%. Having full control over rates, processors can have their own rules for routing each transaction.

(In)Expensive Downgrades of Merchant Services

Transactions routed as NQUAL or MQUAL will bring more money to the processor because they have a higher rate than QUAL that is considered the most affordable tier for businesses. Even though the processor claims that only a minority of transactions will downgrade to UNEQUAL and MQUAL, the customers’ experience shows the opposite.

The Truth Behind Intuit’s Statement

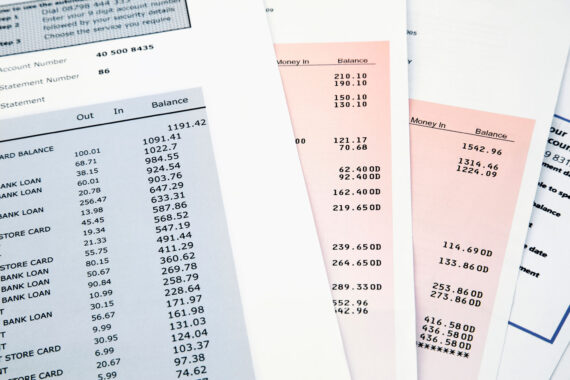

Intuit’s statement includes the number of processed transactions as well as the associated transaction fee and rate. On the other hand, it doesn’t give information about interchange categories, so it is difficult for users to understand if the deal they are getting is the most suitable for their needs.

Overview of Rates and Charges

Besides using different models of charging, Intuit is also using excessive surcharging and hidden costs. That way, the processor is able to increase its cut.

The Mechanism of Concealing

Tiered pricing allows the company to conceal the rate that MasterCard and Visa charge for each transaction behind its own set of rates. The bottom line is that Intuit’s customers never know the wholesale cost of a cashless transaction, so they can’t determine if they are overpaying for the service.

The Tricky Shell Game

Tiered pricing permits a processor to play a shell game with clients’ rates by using inconsistent buckets. In terms of the processing industry, inconsistent buckets mean that when credit card processing costs are based on tiered pricing, it is impossible to compare them.

To process different transactions, banks charge every processor equal interchange fees. Many processors utilize the interchange-plus to transparently transfer these fees straight to businesses, while some, including Intuit, filter the bank’s costs through their rates.

Due to this possibility, the processor offers a low rate that applies to a limited number of transactions. Every transaction that the company processor does not see as qualified is routed to a significantly higher “non-qualified” or” mid-qualified” rate.

The Unclear Fine Print

To ensure that each service provided by the processor is suitable for your business or organization, you need to go through the fine print. For example, when you look at Intuit’s tables, they all seem clear and straightforward. But if you look carefully, you will notice that not all transaction fees are included, even though the print states they are.

Reconsider Your Decision About Using Intuit’s Services

The experience has shown that Intuit’s accounting software is its most preferred product, and many businesses decide to utilize its services. However, plenty of merchants quickly realize the (high) price of it.

Despite Intuit’s efforts to present its offer as multi-beneficial, the price tag that goes with it forces merchants to change their minds about using them. A nontransparent merchant statement is the second reason users start searching for another, more reliable company that offers credit card processing and other services that are more suitable for their business.